This week King’s College London hosted the Anniversary of the Magna Charta Universitatum (MCU), a celebration and exploration of the fundamental values of being a university. Over 200 universities have gathered to discuss ‘What are universities for? Higher education principles, values and responsibilities in a fragmented world’. Over three days, participants engaged in keynote addresses, panel discussions, and interactive sessions exploring the evolving role of universities amidst global challenges. KCL President Shitij Kapur and Professor Liviu Matei explain, “Affirming shared values will help academic freedom weather the storm”.

Continue readingLife As We Live It

Broad Street Ward Mace

Today’s Lady Mayor Show reminded me to share a little history about the mace that accompanies me in the Show, in turn accompanied by the Broad Street Ward Beadle.

Continue readingPepys Day! Part Deux

Yes, I can’t resist an obscure reference to a 1993 parody B, but fun, film, Hot Shots! Part Deux. Pepys Day! Part Deux was also enormous fun with a bit of parody thrown in too.

Continue readingOn The Road Again

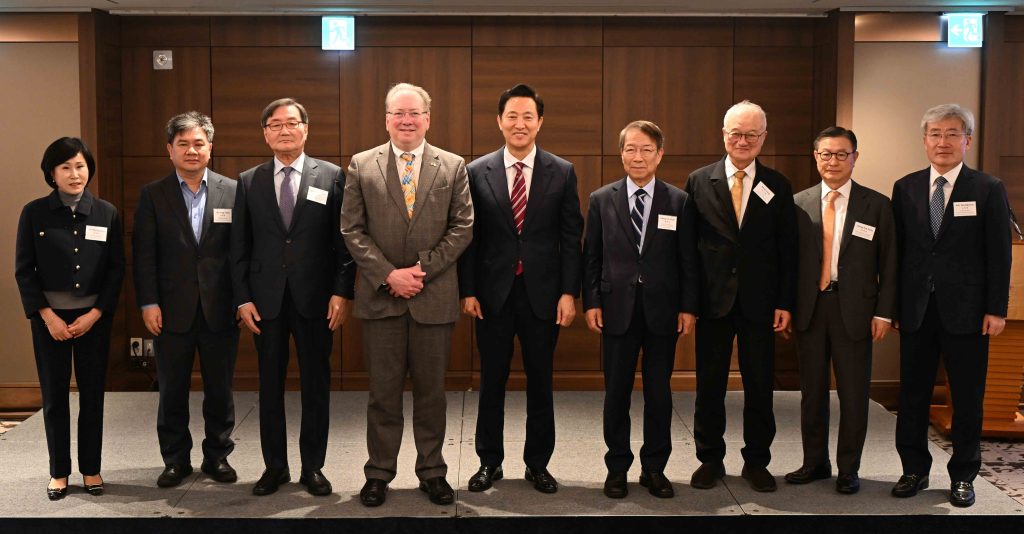

Since the beginning of the year I’ve already spent five weeks abroad, three visiting family in the US and two in Asia, leading me to wonder if being Lord Mayor isn’t such a tough roadshow. Lots of fun, and just sharing a few links to Korea and China if you want to skim a bit of what I was up to:

Seoul – https://www.koreaherald.com/article/10451919, https://biz.chosun.com/en/en-

Incheon – https://www.incheon.go.kr/en/EN020401/3005067

Guangzhou – https://www.gduf.edu.cn/info/1037/13401.htm

Shenzhen – https://en.cdi.org.cn/

Former Lord Mayor Michael Mainelli Appointed President of the London Chamber of Commerce & Industry

Great news to share…

Continue readingSaying Goodbye To A Most Full 2024 & Hello To An Intriguing 2025

So there we were, finally getting a private holiday in after a busy year, when you realise you have a lot of reading time ahead learning about the central position of Tyrol and Maximilian I in European history. Lots to look forward to in 2025. With all best wishes for the New Year to family, friends, colleagues, and anyone else reading this!

Alderman Professor Michael Mainelli Re-elected For Third Term

It was a cordially-contested election with a result of 70% in my favour. My acceptance remarks this evening went:

Continue readingWardmote 2024 – Electoral Statement

Alderman, Ladies & Gentlemen,

After one of his lengthy, repetitive speeches Soviet leader Leonid Brezhnev confronted his speechwriter. “I asked for a 15 minute speech, but that lasted an hour!” The speechwriter replied: “Comrade, it was 15 minutes, but I gave you four copies…”. You’ll be glad to hear I have a single copy.

Club di Londra

What an honour – today I took over as President of the Club di Londra from Sir Rocco Forte, at Brown’s Hotel, a Rocco Forte Hotel, 33 Albemarle St, London W1S 4BP.

Club di Londra is a non-profit organization that acts as a cultural, entrepreneurial, and social hub to strengthen ties between Italy and the United Kingdom. It serves as a place for debate, business, and networking, hosting events like dinners and conferences with prominent figures in economics, politics, and culture. It was founded in 1986 by members of the Italian Chamber of Commerce & Industry for the UK and the wider Italian community. The Club is grateful for enormous support from Ambasciata d’Italia a Londra.

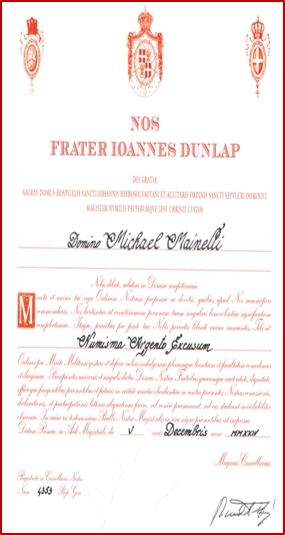

Continue readingKnights Of Malta Medal

What an honour, and a delight, to be awarded a Silver Medal, Pro Merito Melitensi, from the most distinguished Sovereign Military Hospitaller Order of Saint John of Jerusalem, of Rhodes and of Malta for aiding their humanitarian goals.

“Pro Merito Melitensi” is an order of merit awarded by the Sovereign Military Order of Malta for distinguished service that has brought honour and prestige to the organization. It is distinct from the Knightly Order and is bestowed upon non-members, regardless of religion, who have contributed to the Order’s humanitarian goals or Christian values. Recipients do not become members of the Order of Malta or take religious vows upon receiving it.