It was a privilege to host Eurogroup President, Irish Minister for Public Expenditure, National Development Plan Delivery & Reform, and former Irish Finance Minister, Paschal Donohoe at Guildhall and Mansion House for an important talk in London on liberalism and the capital markets union.

Continue readingLong Finance

When would we know our financial system is working?

What Happens If We Burn All The Carbon?

I am delighted that Dr Kevin Parker’s and my paper has come out, “What happens if we ‘burn all the carbon’? carbon reserves, carbon budgets, and policy options for governments“, published by the Royal Society of Chemistry in Environmental Science: Atmospheres.

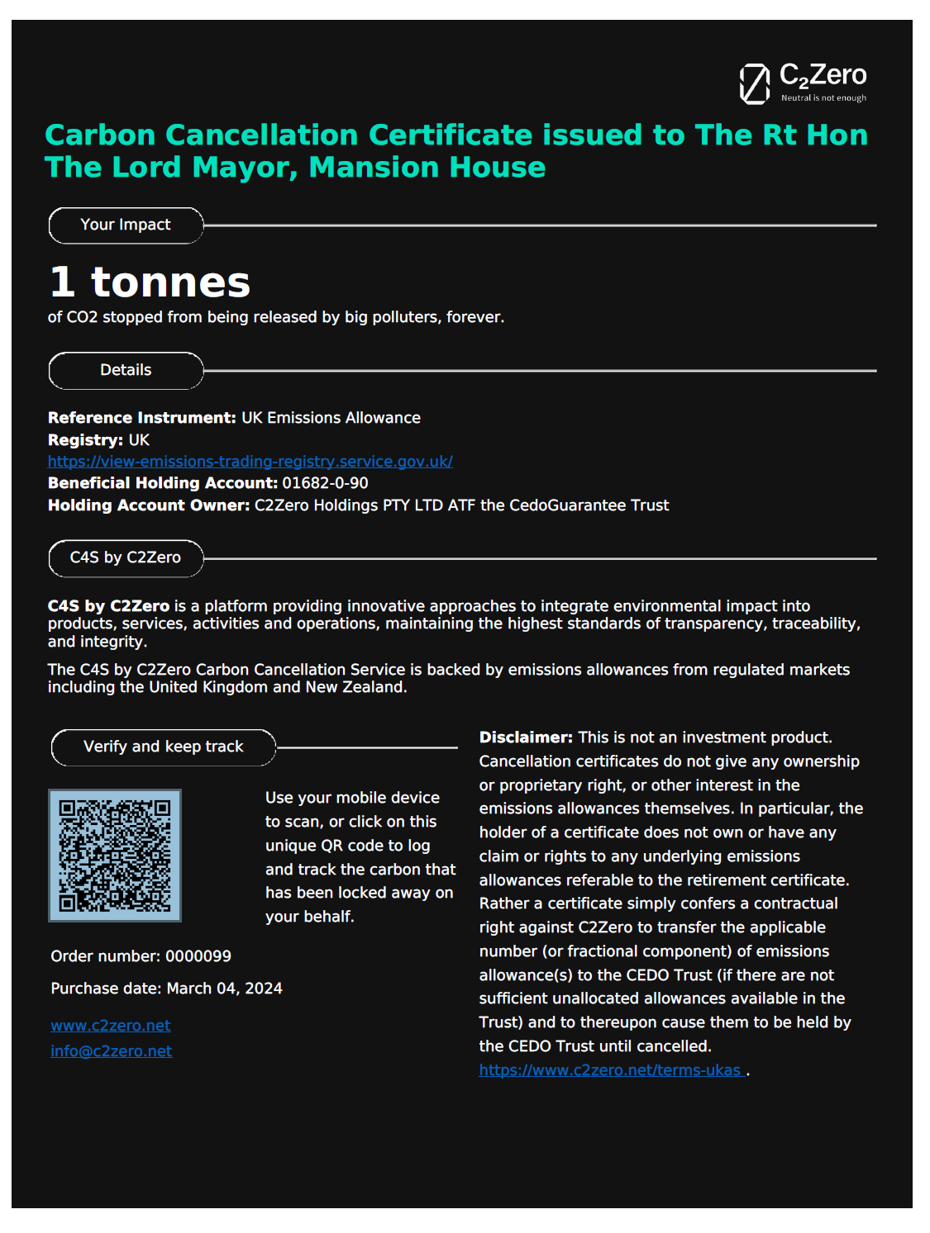

C4S – City Carbon Credit Cancellation Service

This week we are delighted to announce that C4S has been launched with Roger Cohen of C2Zero – try it out to get a certificate for avoided emissions, as above.

| Receipt from C2Zero Order Number 0000099 SUMMARY Payment to C2Zero £ 47.93 Tax (VAT) £ 9.59 Processing fee £ 1.85 Amount paid £ 59.37 |

This article provides a bit more information and my launch text is set out below.

Continue readingArticle: New challenges create new markets – and net zero is no exception

Hasta Mañana

Remarks to: IoD India (Institute of Directors), 2022 London Global Convention on Corporate Governance & Sustainability, The Montcalm, Marble Arch, London, W1H 7TN, 11:00-12:00, Thursday, 10 November 2022.

Boardroom Challenges In A New World Order

Emerging Challenges for Board Leadership in the New Economy

Building high performance Boards in uncertain times: Balancing Strategy, Operations & Compliance

Board’s oversight for fundamental Seismic Shifts in Global Geopolitics & guide to a disrupted world

Board’s Human Capital Strategy – Rising to the Challenges of the Future Work Place

Board Leadership and Strategy for leveraging corporate culture and value chain

Continue readingEnvironmental Social Governance of Investment

Remarks to:

The Guild of Investment Managers at Farmers’ & Fletchers’ Hall, City of London, Thursday, 17 October 2019

My fellow Alderman and your Master, Robert Hughes-Penney, kindly asked me to provide some opening remarks. I do wish I could stay longer, but as fellow Livery folk, you’ll understand that an Immediate Past Master of the World Traders needs to attend our Installation Dinner at 19:00 to become an Immediate Past Past Master or an Immediate Immediate Past Master, or some such.

The comedian Jay Leno once quipped, “According to a new UN report, the global warming outlook is much worse than originally predicted. Which is pretty bad when they originally predicted it would destroy the planet.” Sadly, that quip was from 2007.

Continue readingWorld Exchange Forum – Innovation & Transformation

My dear friend Herbie Skeete heads up MondoVisione. His 2019 Forum at Haberdashers’ Hall led to some great insights on the nature of global finance. The highlight was probably an address and interview with Gina Miller, the campaigner behind two Brexit court cases.

Continue readingMaking Risk Normal

“You Never Stop Trading” – Institute Of Export Awards Ceremony

Institute Of Export

Keynote

Alderman Professor Michael Mainelli

23 May 2018, Mansion House

“You Never Stop Trading”

Minister, Aldermen, Fellow Masters, Ladies, and Gentlemen.

The City of London, what better place to graduate in trade and export. The Inspector of Ancient Monuments assures me that London’s archaeological evidence proves over 100,000 years of trading. Bloomberg across the road sits above two millennia of Londinium. We convene for this graduation ceremony over a millennium old stocks market. You are at one end of Cheapside, ‘cheap’ being Anglo-Saxon for ‘market’. One New Change at the other end by St Paul’s is its modern shopping mall. Gresham’s Royal Exchange opposite is over 450 years old.

The word ‘monger’ is old Saxon-German for trader or trafficker. Think, ‘drugmonger’. This trading City is therefore full of Ironmongers, Fishmongers, Lightmongers, Costermongers, Cheesemongers, and even Fearmongers. What am I as Master of the World Traders? Perhaps I should be a WorldMonger or GlobeMonger. Pssst, hey buddy, want to buy a planet?

From Adam Smith onwards, thinkers have increasingly recognised that commerce is about much more than just making money. Commerce is about exchange between people. Commerce is about social interactions where people trade ideas, opinions, or merchandise. Good commerce is a positive sum game. Trade reaps economic benefits from specialisation and comparative advantage, creates prosperity, distributes success and wealth, and collectively enriches all of our societies and communities. Trade is a force for good.

This year’s Lord Mayor, Alderman Charles Bowman, promotes the Business of Trust. His research sets out five principles for trust – five good principles for new graduates. Remember the mnemonic C-I-V-I-C:

• Competence and skills – doing what you do well;

• Integrity – being honest, straightforward, and reliable;

• Value to society – recognising and meeting wider societal needs;

• Interests of others – respecting the interests of customers, employees, and investors;

• Clear communication – being transparent, responsive, and accountable.

Trust underpins all trade and investment, firmly based on the City of London’s motto, “Meum Fidem, Meum Pactum” (“my word is my bond”). Trade should be win-win with other people. As the UK increasingly focuses on trade, remember that no-one should ‘export to’, everyone should ‘trade with’.

So CIVIC, I repeat:

• Competence

• Integrity

• Value to society

• Interests of others

• Clear communication

What I admire about you is that by starting, and finishing, your studies with the Institute of Export you exemplify all five CIVIC principles. You have studied to increase your Competence. Your Integrity in enshrined in your learning. Your Value is inherent in your increased professionalism. You couldn’t trade ethically without taking the interests of others to heart. You have worked hard on communicating your thinking and ideas. You deserve today’s awards.

The Jesuit scholar, Timothy Radcliffe, talks about universities and further education as places where we “learn to talk to strangers.” As you trade with strangers, they become colleagues, and later colleagues become friends.

But education and trade don’t stop here. All of life is learning and trade. In fact, I’ve improved a bit of Shakespeare to get that point across. Indulge me:

All the world’s exchange,

And all the men and women merely traders;

They have their wares and their merchandises,

And one man in his time plies much commerce,

His acts being short changes. [Jacques: As You Like It, Act 2, scene 7, lines 139-143]

I run a technology and finance research firm that is about 90% exports, so this year, the World Traders, young and old, Journeymen your age to ancient Liverymen like me, have focused on “Technology & Trade” as our theme. We are studying how technology transforms trade through debates, workshops, and even research into blockchains, published at the House of Commons last month as “The Economic Impact Of Smart Ledgers On World Trade”. You too will continue to learn through life, or stop living. An old quip goes, “Live as if you were to die tomorrow. Learn as if you were to live forever.” Or as Seneca the Younger stated, “As long as you live, keep learning how to live.”

So, as graduates, should you be optimistic or pessimistic? A number of nationalities walk into a bar and are asked, “are you optimistic or pessimistic?”:

• the Englishman says, “pessimistic, Brexit & Remain”;

• the Scotsman says, “pessimistic, Brexit & Referendum”;

• the Irishman says, “pessimistic, Brexit & Border”;

• the American says, “pessimistic, Trump”;

• the Italian says, “pessimistic, elections”;

• the German says, “pessimistic, Euro”;

• the Australian says, “pessimistic, North Korea”;

BUT the World Trader says, “optimistic, pessimism is for better times.”

And you have such great opportunities. The world is changing as never before, socially, technologically, economically, and politically. It may be a bit crowded now, seven billion people is over double the world I was born into, but even that will change as we are looking to demographic numbers reversing direction about 2050. You will have outstanding chances to use your learning. You will never stop learning and trading.

May I ask you, the graduates, to go forth inspired by the motto our Worshipful Company of World Traders traded with Thomas Jefferson from 1801, “COMMERCE AND HONEST FRIENDSHIP WITH ALL.”

May I wish all of you the success you will earn.

Thank you.

It’s Not All About Winning, Unless You Win

I had a wonderful time at the City Debate last night, Tuesday, 6 March. Here’s a photo of all of us at the start:

CSFI & CISI City Debate:

- Antony Jenkins (10x)

- Nikhil Rathi (London Stock Exchange)

- Michael Mainelli (Z/Yen)

- Ruth Wandhöfer (Citi)

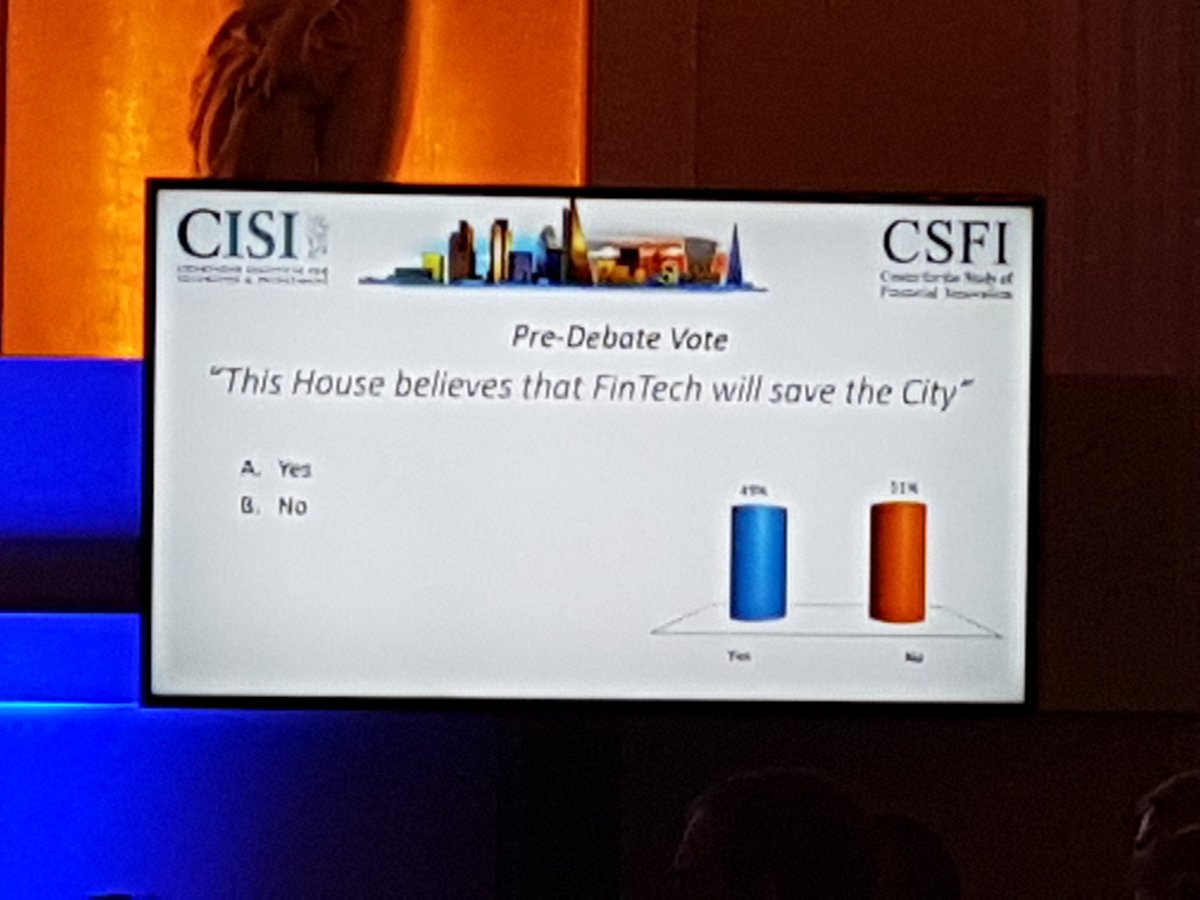

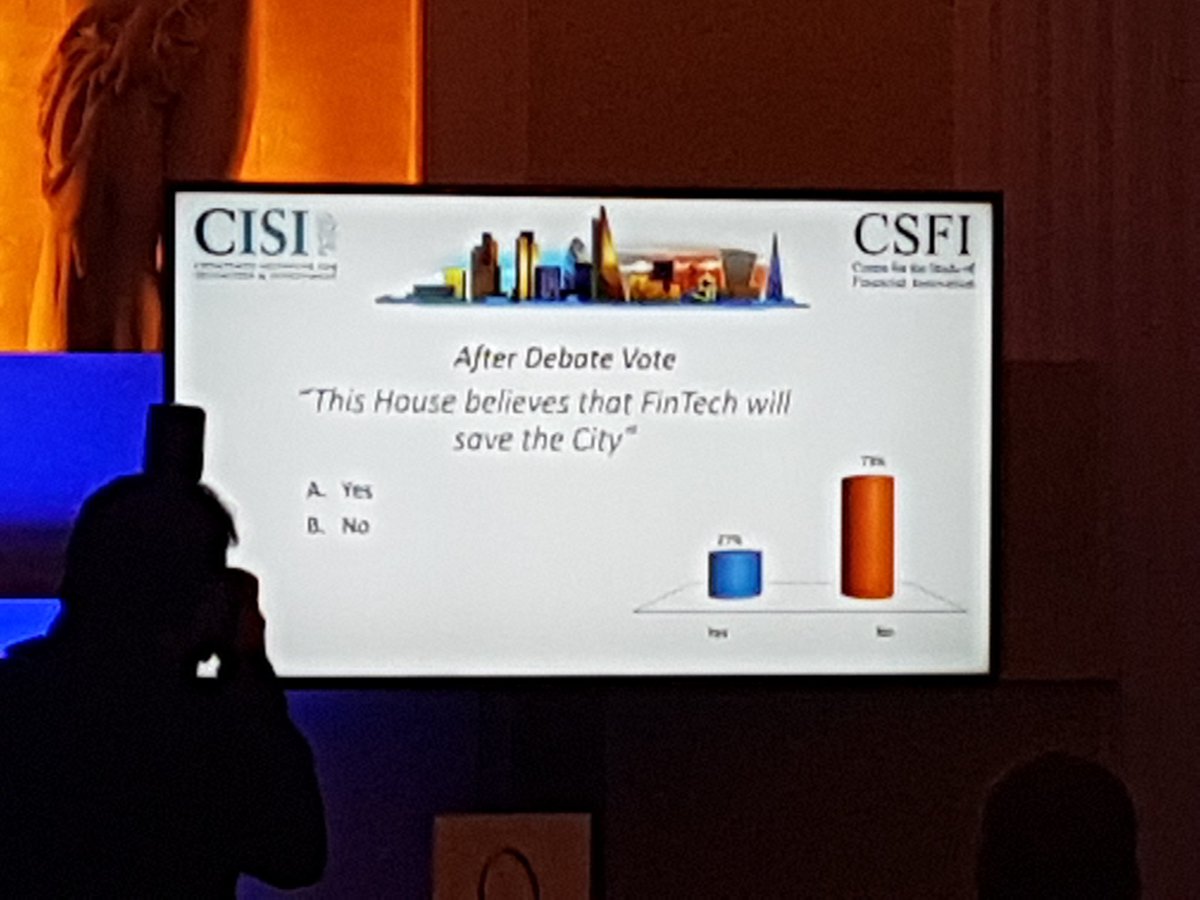

You can spot Ruth on the left, with Angela Knight in the centre who chaired proceedings, and Alderman Alan Yarrow both as Chairman of CISI and as Lord Mayor Locum Tenens. The pre-debate vote was neck-and-neck, 51% “no” (Antony and my side) and 49% “yes” (Ruth and Nikhil’s side).

From the questions it appeared a hostile audience to Antony and me. I had that queasy feeling you don’t like when you’ve volunteered for a competition just for the fun of it, then suddenly realise you could lose in front of all your friends. How can one’s self-esteem ever recover?

Now you can see me in full ‘must win’ mode, or as my friend George Littlejohn would have it – “Michael could be up for playing Churchill come the next biopic.”

Thus it was a genuine surprise, and relief, to find that we moved the audience significantly to our side, 73% to 27%. Whew.

In case my position had anything to do with swaying opinion, I set out the case against, below:

“This House Believes That Fintech Will Save The City” (NOT)

Lord Mayor Locum Tenens, Your Excellencies, Fellow Aldermen, Distinguished Guests, Ladies and Gentlemen.

You heard Antony’s compelling words. My argument balances his. If Fintech doesn’t destroy you, then … Fintech will remain, a small comfortable parasite on the technology and trade centre that is our global City. So what is the City, what is Fintech, what needs saving?

Yesterday, the Inspector of Ancient Monuments assured me that London’s archaeological evidence proves over 100,000 years of trading. I ask you, many of you too also ancient monuments before me, to join together and take a long-term perspective. Bloomberg across the road sits above two millennia of Londinium. We convene over a millennium old stocks market. Gresham’s Royal Exchange opposite is over 450 years old.

With the tragic exception of Edward I’s expulsion of the Jews in 1290, what distinguishes London is that, by comparison, it has treated all comers from outside the walls fairly, so long as they adhere to “meum fidem, meum pactum”. Lombards, Huguenots, Rothschilds, Warburgs … Mainellis.

We are an SME City. 24,000 businesses provide 483,000 jobs in the square mile, with 1,200 more each year. Yes, 250 firms provide 50% of the jobs, but they work with 23,750 deal-making SMEs. Large and small produce 3% of UK GVA from less than 1.5% of the workforce, three quarters of the UK’s services trade surplus, some £68bn.

Urban legends mislead us. The City was a deal centre before and after WWI, but was a feeble financial centre from 1939. The finance legend was kept alive by Italians and Americans, Autostrade in 1963 creating Eurobond markets on neutral territory. When Thatcher lifted exchange controls in 1979 and Big Bang broke cartels, financial services boomed. Most of today’s behemoths were SMEs 30 years ago. Bloomberg dates to just 1981.

You’ve heard of a Baker’s Dozen, 13? I recently learned that a Banker’s Dozen is 11. Just seven banks, not even 11, gets you to over 95% UK market share. Cartels remain. Domestic banks pursue a decades old, yet rational, strategy of hampering account switching. If you want to be a success in retail Fintech, go to a country with over a thousand banks, Germany, or over six thousand banks, America. Make some marketing director’s career rather than annoy a UK bank strategist.

Our retail fintech story is government lies for children, baubles with no Christmas tree:

- M-Pesa in Kenya dates to 2007, eight years before the UK notices Fintech.

- Retail Fintech kids unable to afford desks sit in Level 39 beside the compliance & admin battery hens of Canary Wharf, while Berlin, a quarter our size and not a global financial centre, raises more Fintech finance than we do.

- China has 13 Fintech unicorns to our four. Even that requires forward-dating things like WorldPay, 1995, just to fake our numbers up.

Then we put our regulator in charge of a sandbox, letting government bottlenecks choose our winners. Any country whose regulator is in charge of innovation has deep problems. The wider City is lawyers, accountants, maritime, insurers, not a fintech pimple.

Google Trends awards the term ‘Fintech’ around 100 points. In January 2015 it was an insignificant six points. Our government claims creation of a sector it didn’t even notice four years ago, putting some mobile app lipstick on the antiquated systems of some oligopolistic banks.

I came to the City in 1984 to put computer technology into Messels, then Shearson-Lehman-Amex. We old-timers should celebrate the progress of automating wholesale finance. We’ve been doing real Fintech long before this insulting term was mashed up. It’s as facile as saying your heartbeat keeps you from dying.

London is a science & tech city. From Tudor ‘New Learning’ to Gresham College, Francis Bacon, the Royal Society, Industrial Revolution, Wheatstone telegraph, or DNA (the work was done at Kings, not Cambridge), London has been at least as much about science & tech trade as it has been about finance. Technology-Media-Telecomms is a significantly larger percentage of firms under 100 employees than finance, insurance, or professional services. Our centuries of tech drive regtech, instech, arttech, filmtech, songtech, medtech, edtech, traveltech.

Finance moves with technology too, from cuneiform to papyri to tally sticks to spreadsheets to databases and now databases-plus, smart or distributed ledgers, blockchains. But smart ledgers are ‘wide tech’ for identity, documentation, and agreement exchanges, not just payments. Tech is for all sectors and the City of London is the most intense place on the planet to do tech deals.

So does the City need saving from Brexit, the wider UK, perhaps AI? To paraphrase Streisand, “people who need to trade with people, make London the luckiest City in the world”. As long as we focus on face-to-face, commercial, global deal-making that AI and telecoms can’t replace, deal support will thrive, from financial and professional services to hotels, culture, healthcare, or entertainment.

With or without Brexit, we need quality education and training, health, infrastructure, broadband; airports (plural); an in-visa-ble as possible access to people; a functioning housing market; a simple tax system. If Britain is open for business, try opening a bank account. What always needs saving is the rule of law, innovation, and open deal-making. We are deficient, but not desperate; in danger of having our Emperor’s clothes disrobed, but with time to knit some new garments.

In conclusion, profound changes would be needed to even start to be a standalone Fintech centre. Silicon Valley, in total, is still only half the size of London. Fintech propaganda hides three decades of wholesale finance automation. Our real strength is over 500 years of wider technology and open trade. Sell Trade in Tech not Fintech.

So, do you vote for deep tech or mobile gimmicks, do you vote for City deals or for Canary Wharf turkeys, do you vote for people or machines? Our centuries of success are built on growing SMEs in open, global trade, not some three year old government mashup. Please vote for yourselves, the deal-makers of London, not this facile motion.

References