The Financial Services Group of Livery Companies asked me to provide an inaugural FSG Lecture in memory of its Founding Convenor, Jeremy Goford, Past Master Actuary“London Forever! Reality or Rhetoric?” I was pleased to deliver it on Wednesday, 20 September 2017 at

Mercers’ Hall, London. Though I met him late in life through the livery movement, Jeremy and I enjoyed many conversations and disputations on the auditing, accounting, and actuarial professions, especially their use of numbers. Jeremy’s love of our City was palpable. I was delighted that the Financial Services Group of Livery Companies chose to honour his memory with this inaugural lecture, While you can read the full transcript, with slides – Jeremy Goford Memorial Lecture – London Forever – Reality or Rhetoric 2017.09.20 v1.3

Though I met him late in life through the livery movement, Jeremy and I enjoyed many conversations and disputations on the auditing, accounting, and actuarial professions, especially their use of numbers. Jeremy’s love of our City was palpable. I was delighted that the Financial Services Group of Livery Companies chose to honour his memory with this inaugural lecture, While you can read the full transcript, with slides – Jeremy Goford Memorial Lecture – London Forever – Reality or Rhetoric 2017.09.20 v1.3

a summary was published in Fintech Finance on 25 September, reproduced below:

London Forever! Reality Or Rhetoric?

This month, Z/Yen Group, published the 22nd edition of the Global Financial Centres Index. GFCI 22 showed almost all major financial centres following the downward lurch of London and New York in GFCI 21. In the top 20, only Frankfurt rose, quite significantly due to many London bank announcements of headquarter moves.

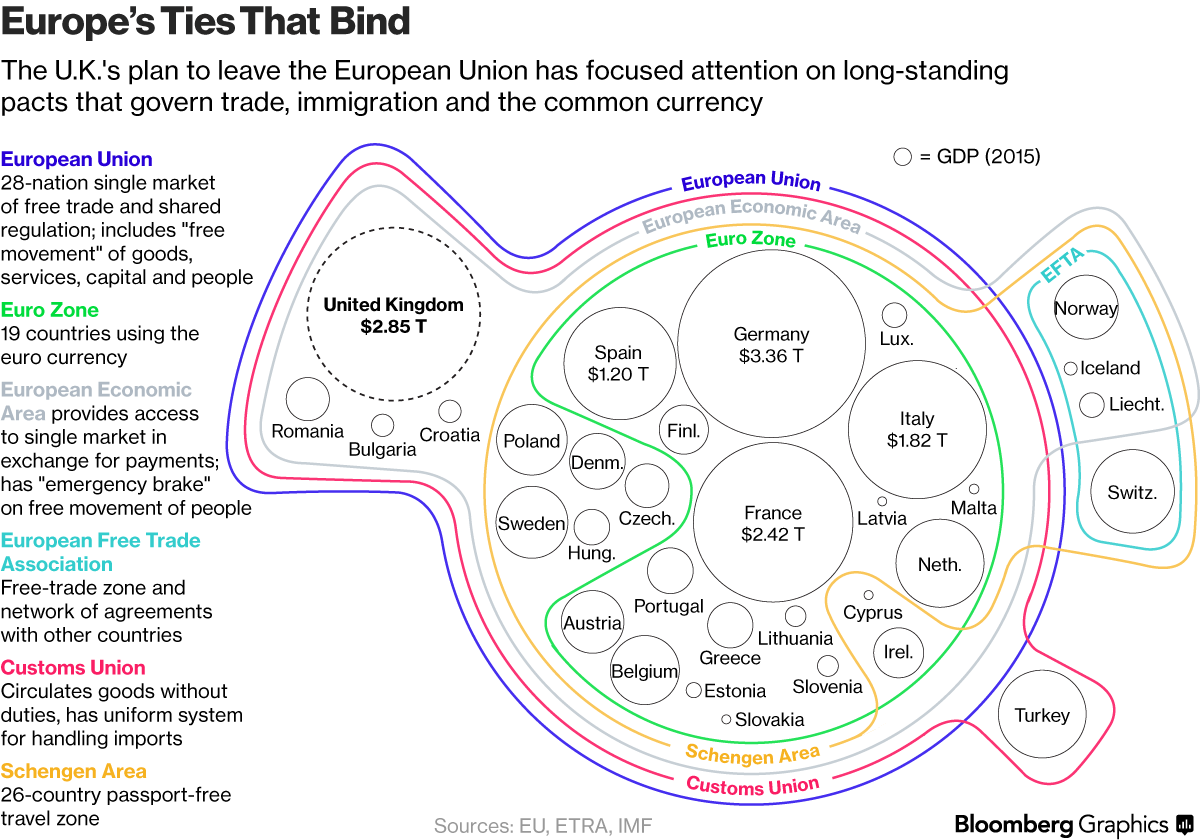

Finance only exists to support the ‘real economy’ of commerce and trade. This telling tumble among financial centres is due to fears over trade, not finance. ‘America First’, isolationist rhetoric damages perceptions of future US trade, while Brexit rhetoric harms perceptions of UK and European trade.

With so much changing, it is right to ask whether London will forever be the premier global centre for professional, business, and financial services. Financial centres do rise and fall, from Amsterdam to Izmir to Zanzibar. The 1375 Catalan Atlas of the known world by Abraham Cresques of Mallorca has an inscription: “This lord is Musa Mali .., so abundant is the gold which is found in his country that he is the richest and most noble king in all the land.” Musa hailed from Timbuktu in today’s Mali.

London’s five centuries of success are due to a sustained confluence of several factors, the ‘accidental’ ones being maritime location, early infrastructure, Continental wars, and the rise of the USA over the past century. Our index comprises well over 100 ‘intentional’ factors, but I would emphasise the business environment, a trading culture, and the rule of law. However, people like simple answers, not statistics. So just two things, structural intensity and fair treatment.

All cities are intense, but structural intensity is special to the City of London. With only 9,000 residents and 450,000 commuting workers, it’s a 98% chance anyone you meet on the street is working. And Crossrail’s success will raise that chance to 99%. A temperate climate, twisting alleyways, and numerous drinking places ensured that from the time of the Tudors financial workers met each other frequently. From pubs to coffee shops to Americano & Cappucino networking centres, supplemented by air transport and IT.

While the UK’s £61 billion trade surplus from financial services is exported via electronic pipes, deals need face-to-face trust to start, and often to complete. We need to keep raising that intensity of contact as the City of London Corporation is doing by planning for significantly more pedestrians. Video-conferencing supplements deals, but we still need to meet, often unplanned.

The belief that all comers will be treated fairly has been a London success factor since the 1290 mistake of expelling the Jews. London’s subsequent welcoming history needs no recounting, from Lombards of old to welcoming back the Jews in 1655 to today’s Syrians. All were increasingly treated with the same commercial rights as Englishmen. Rule of law is crucial, but long before anyone goes near a court, any nation that wishes to prosper must trade from an open and competitive environment. Competition needs a well-educated populace with a state sector preventing cartels, barriers-to-entry, information asymmetries, and agency problems, while not crowding-out markets.

If we get our own house in order, trade will come. Brexit doesn’t change the basics. You can’t be an international centre without international people. Successful people want to live in successful places. Successful places are cosmopolitan. Reputation is vital: 20 years to build and five minutes to ruin. We have problems certainly. If Britain is open for business, try opening a bank account.

We have problems certainly. If Britain is open for business, try opening a bank account. With or without Brexit, we need to stimulate investment in quality education and training, health, infrastructure, broadband; sort out the airports (plural), make the nation as ‘visa less’ to get to as possible, make financial account-opening a one minute process, create a competitive housing market, simplify the tax system, and so on. Brexit adds the complexity of ‘transition’ being woefully unclear, ‘trade’ structures breaking down, and welcoming ‘talent’ uncertain. So we need swift decisions on timing, on terms-of-trade, and talent, for example stop prevaricating on EU nationals’ and students’ status.

Our reality must rise to meet our rhetoric, but it was ever thus. In the history of London we see the truth of Aldous Huxley’s comment, “The charm of history and its enigmatic lesson consist in the fact that, from age to age, nothing changes and yet everything is completely different.” Making London a great place to live solves most problems. We need to be honest about our faults and not let false rhetoric impede fixing them. We are deficient in some areas, but not desperate; in danger of having our Emperor’s clothes disrobed, but with time to knit some new garments.

We’ve been being told for well over a year what we supposedly voted for in a non-binding referendum. Whatever, the vote was certainly a vote for change. Quality guru W Edwards Deming sets a low bar for the lazy: “It is not necessary to change. Survival is not mandatory.” I am sceptical about claims that we businesspeople will find fabulous fortunes hitherto overlooked in far-flung foreign lands, but I am very positive the closest opportunity is change for the better at home, toward improved structural intensity and fair competition. Londoners are certainly not lazy.

Trade reaps economic benefits from specialisation and comparative advantage. Trade creates prosperity, shares success, and enriches our environment. Trust holds all trade relationships together. The clearest sign of trust is that people want to live and work in London and the UK. If we keep that, we keep everything, including the top spot a century from now in Global Financial Centres Index 222.