Published: Thursday, 23 June 2016 10:53

Long Finance Blog – The Pamphleteers

Hopefully, Thursday, 23 June 2016 is a quiet, slow news day with everyone at the polls. Regular readers know that Pamphleteers is about the long-term. We have published only a little on the EU Referendum. I thought I’d exhibit some courage and try to write a long-term post for today with the referendum result pending and uncertain.

To remind those of you reading this from the future, on 23 June 2016 the UK voted on the United Kingdom European Union membership referendum, asking the electorate – “Should the United Kingdom remain a member of the European Union or leave the European Union?” It has been a noisy, acrimonious, and vacuous campaign by both sides. Many voters, myself included, resent having to vote on what was, initially, an internal Conservative party problem due to poor strategy, poor leadership, and poor discipline. The Conservatives are split one from the other in almost two separate parties. Labour’s leadership is split from Labour’s membership. Many things have been said that cannot be unsaid. And with referenda (yes, I’m grammatically stubborn here) now so easily called I fear another one coming, perhaps on a vital subject with no proximate cause, “shall we drive on the right instead of the left?”.

Obviously the big decision will be to ‘leave’ or ‘remain’. But the implications of ‘to leave’ or ‘to remain’ hinge on how large the leave or remain margins are, turnout percentages, on the various splits between the four nations (Wales, Scotland, Northern Ireland, England) and the political parties, as well as on the extent of clear divisions by age, gender, ethnicity, urban versus rural, education levels, and London & the Southeast (themselves perhaps divided with central London versus the Home Counties or central London versus suburbs) versus the rest of the country. Whew. Lots of analysis and different interpretations coming. And lots more UK politics.

I have had the opportunity to travel widely around Europe on work much more than usual during the course of the campaign. Outside the UK, there are also things to do. Other Europeans are hurt. They don’t understand why the UK had this referendum, at this time. In rebuilding any relationship one should:

· Acknowledge that trust was broken.

· Admit your role.

· Apologise for how you acted and what happened.

· Appraise where you particularly broke trust and how you can be more connected, committed, and dependable.

· Amend and plan ahead.

Acknowledge, Admit, Apologise, Appraise – the UK needs to walk round the EU and do these things, whether in or out. If ‘in’, then it would be nice to walk round with the hands of supportive partners, Ireland, the Netherlands, Germany, … there are many countries who earnestly want to partner.

And what might “amend and plan ahead” contain?

1 – In the UK, commit to EU reform. When a light bulb burns out, you don’t buy a new house, you fix the light bulb. UK political parties should write specific EU reforms into their manifestos.

2 – Around Europe, remove direct EU foibles. There are some very obvious points of attack that have been made more evident in this campaign, the waste of two EU parliamentary seats – remove Strasbourg – unaudited accounts, some regulation, complete the common market in services, etc. All EU members can use this as an opportunity to do the obvious and remove easy targets for demagogues around the EU.

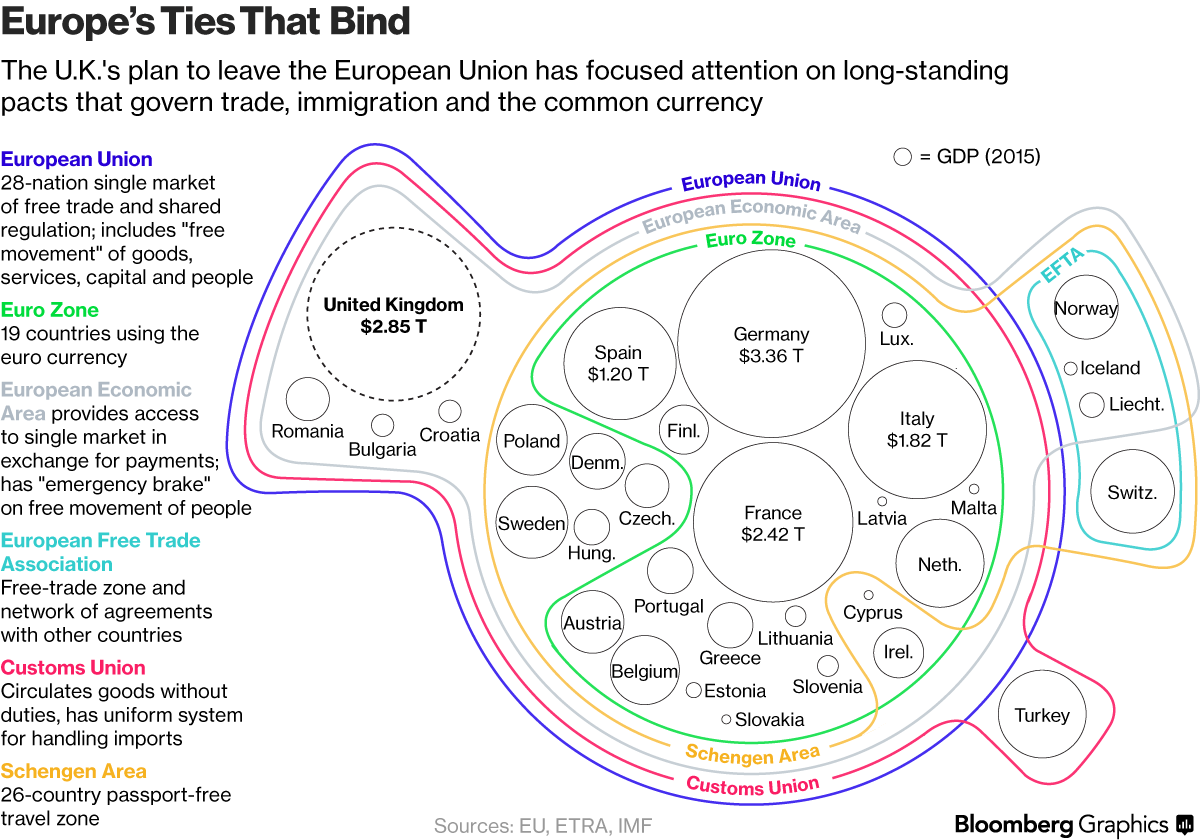

3 – Around Europe, set out an exit plan for a member state to leave the euro. There should be the banking regulatory equivalent of a ‘living will’ for a member who wishes to leave. The euro cannot be a lobster pot. Nor should one country’s problems with the euro be guaranteed to precipitate an EU crisis. Yes, the euro-zone might shrink, but it is unlikely to fold. Perhaps there is an optimal size that happens to be smaller but far better for members. Perhaps the euro-zone will grow when it is grown up enough to recognise that there will be leavers as well as joiners over the long-term.

4 – Around Europe, address the democratic deficit of the EU. The knee-jerk reaction to ‘EU democratic deficit’ is to give powers to the European Parliament. Here I have a strange suggestion. The European Parliament exacerbates the democratic deficit rather than fixes it. Any trade agreement requires some form of submission to a greater good, but the more the Parliament is strengthened the more sovereignty issues it creates. The more it is strengthened the greater the dissonance between “no more ‘ever closer union'” and the intentions and desire for power of such a body. There are two democratic lines now, national parliaments and direct European elections. These dual electoral lines have had led to confusion. People kick the establishment on European elections while voting pragmatically in national elections. These dual lines have funded fringe parties of right and left confusing national elections. There are many things to discuss here, e.g. directly elected commissioners, the origination of legislation, national parliamentary representation, etc. Whatever, consider constitutional reform, perhaps even the abolition of the European Parliament.

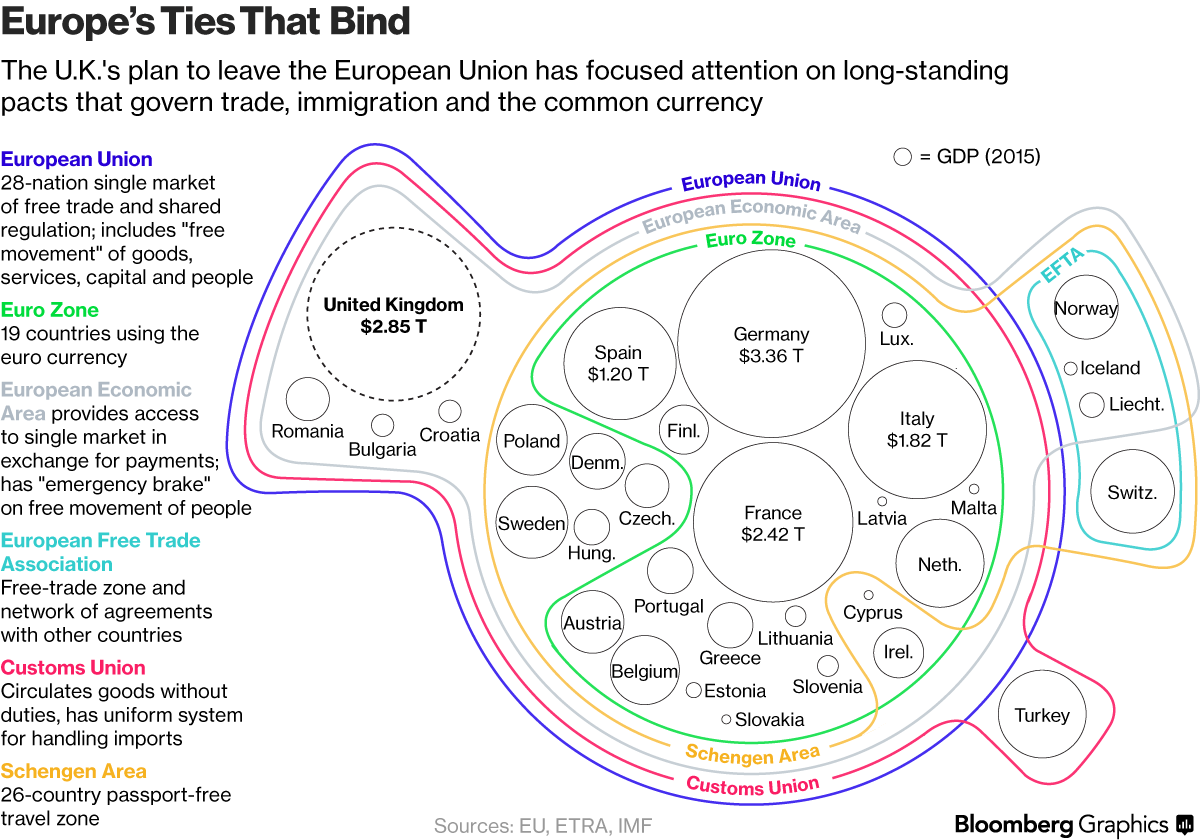

If nothing else, the EU Referendum campaign repeatedly focused attention on three issues – economics, sovereignty, and immigration. Economics matters everywhere. The UK is not the only country with sovereignty concerns about the EU. Two-to-four above do little about immigration. UK perception aside, immigration reality is a bigger issue in the EU than in the UK.

And if the UK votes leave today? Then Europe should still undertake points two-to-four above – fix the obvious, fix the euro, fix the constitution – though sadly without what might have made a great long-term partner.